|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Good Home Mortgage Lenders: Key Considerations and InsightsFinding a good home mortgage lender is crucial for securing favorable terms and a smooth home-buying process. With numerous lenders available, making the right choice can be challenging. This article explores essential factors to consider and offers insights into choosing a reliable lender. Understanding Mortgage LendersMortgage lenders are financial institutions or individuals offering loans to purchase real estate. They assess your financial status and determine the loan terms, including interest rates and repayment schedules. Types of Mortgage Lenders

Key Factors in Choosing a LenderWhen selecting a mortgage lender, consider the following important factors: Interest Rates and FeesCompare interest rates and fees among lenders. A lower rate can significantly reduce your long-term costs. Customer ServiceExcellent customer service can simplify the loan process. Look for lenders with positive reviews and responsive support. Loan OptionsEvaluate the variety of loan products offered. Whether you're interested in mobile home financing in Minnesota or another specific need, ensure the lender provides suitable options. Steps to Finding a Good Lender

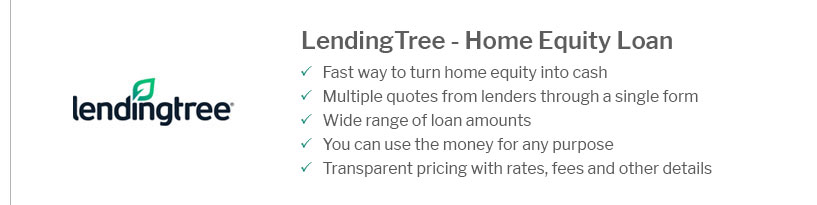

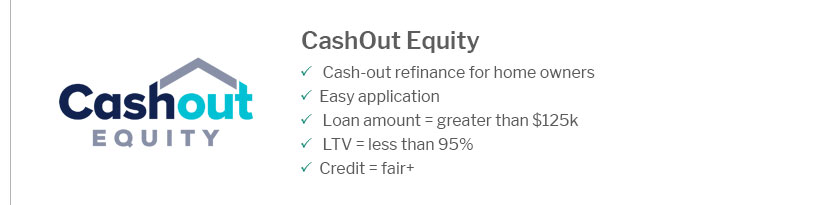

Frequently Asked QuestionsHow do I compare mortgage lenders effectively?To compare lenders, examine their interest rates, fees, loan options, and customer service. Use online comparison tools and consult with financial advisors if needed. What role does my credit score play in securing a mortgage?Your credit score significantly impacts your eligibility and the interest rate offered. A higher score typically results in better loan terms. Are online lenders a good choice?Online lenders can offer competitive rates and convenience, but it's essential to verify their credibility and customer reviews before proceeding. ConclusionSelecting a good home mortgage lender requires careful consideration of various factors, including interest rates, loan options, and customer service. Whether you're seeking the best cash out refinance or another mortgage solution, thorough research and preparation can lead to a successful outcome. Remember, the right lender is pivotal to achieving your home ownership dreams. https://money.usnews.com/loans/mortgages/best-mortgage-lenders

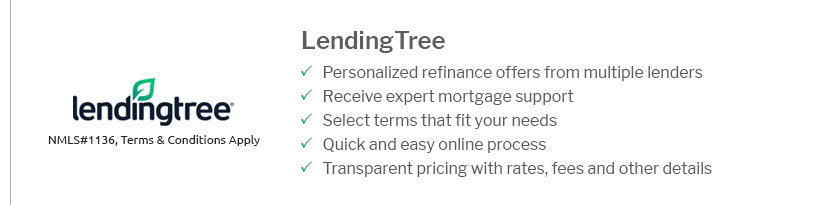

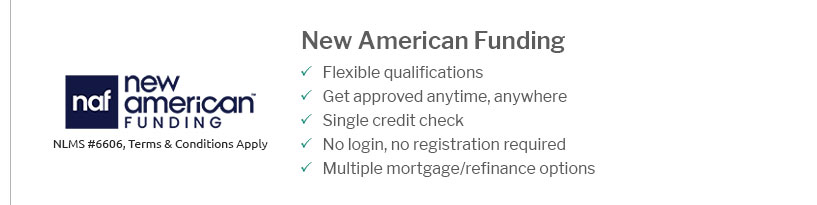

U.S. News' Picks for Best Mortgage Lenders ; New American Funding. 4.7. NMLS #6606 ; Rocket Mortgage. 4.9. NMLS #3030 ; Farmers Bank of Kansas City. 4.7. NMLS # ... https://www.lendingtree.com/home/mortgage/best-mortgage-lenders/

Best mortgage lender for VA loans: Rocket Mortgage - Best lender for overall online mortgage experience: Zillow Home Loans - Best mortgage lender for FHA loans: ... https://www.hsh.com/best-of/best-mortgage-lenders-for-high-credit-scores/

Best Mortgage Lenders for High Credit Scores - AmeriSave - loanDepot - Veterans United - Chase - Rocket Mortgage ...

|

|---|